A good home insurance plan is a safety net you hope you never need to use, but is vitally important

should you ever need it. Just like with most household bills, however, it pays to switch regularly to ensure that

you don’t end up overpaying.

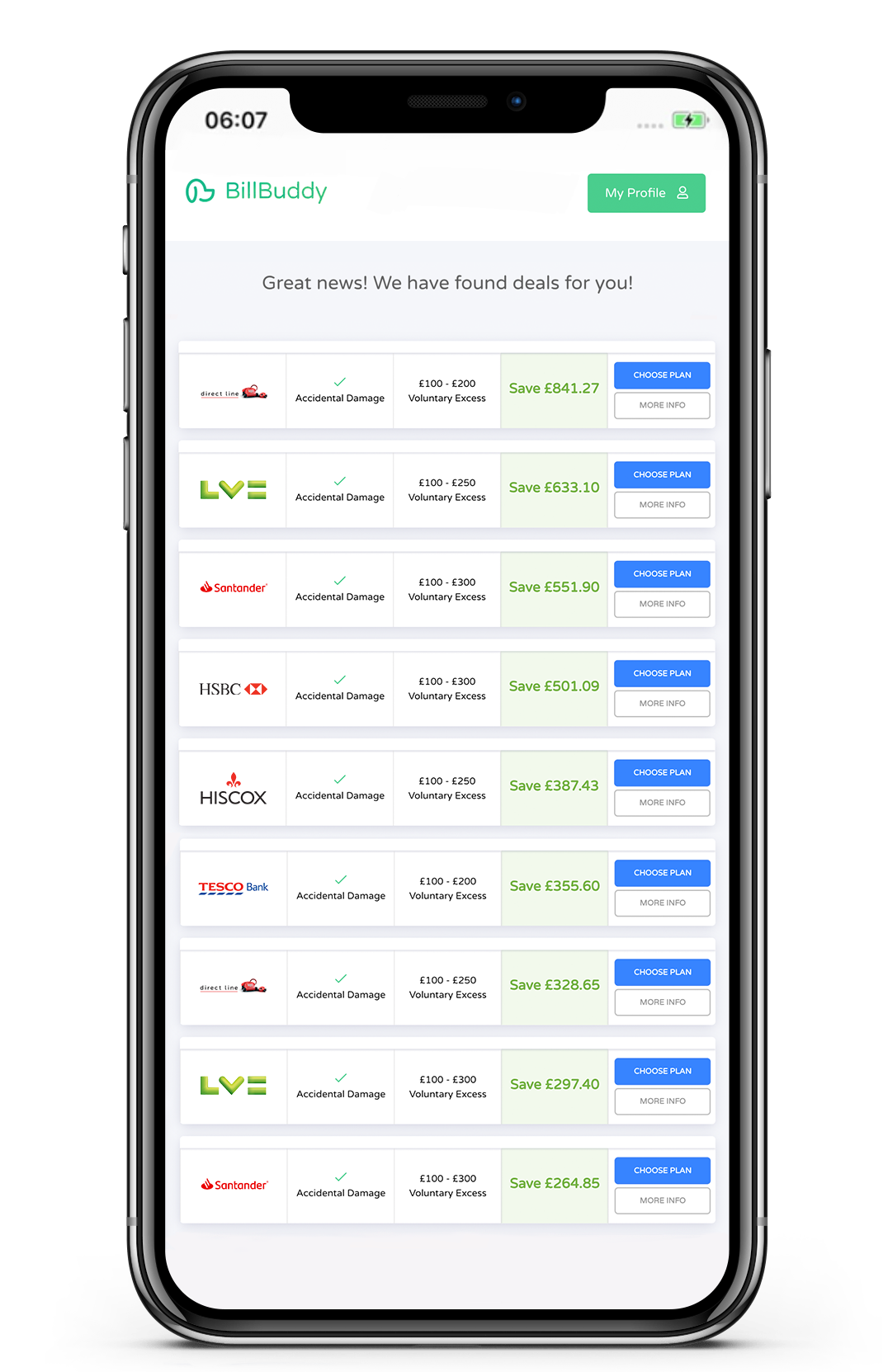

Switching your home insurance policy is very simple - you enter your information once and compare policies from top

providers, then we’ll remind you when it’s time to switch again. As you’ve already given us your information,

we’ll save it for next time to prevent you re-entering it.

You get a competitive rate for your home insurance year after year.

Whilst having a home insurance policy is not a legal requirement, your mortgage provider may insist that you have coverage for the duration of your mortgage. Home insurance is like a safety net which covers you against something happening to your property or its contents.

Whether you take out buildings, contents or combined policy is completely up to you, and depends on your personal situation.

If you own your home and pay a mortgage, it’s likely that your mortgage provider will insist on you having buildings insurance as a way to protect their investment. If you rent, it’s likely that your landlord will have buildings insurance so you’ll only need contents insurance.

Of course, homeowners also want to insure the contents of their home - if this is the case, a combined buildings and contents insurance is what you need.

Accidental damage cover insures you against damage that occurs suddenly as a result of an unexpected and non-deliberate external action. That’s the official definition, but in realistic terms that can mean anything from a smashed vase to hammering a nail into a water pipe.

Whether you need it or not is entirely up to you - if there are small children in the property, it might be worth the extra cover as they’re often the culprit for much of the accidental damage that happens in our houses.

Content insurance should cover anything you’d take if you moved house, including things like carpets and curtains. Take a reasonable estimate of everything you’d take with you if you were to move and add it together to get the contents value of your home.

"Getting the right level of cover for your situation is the first step, so think about whether you need buildings, contents or a combined policy. Once you know that, take some time to make a fair calculation of the contents of your property (assuming you’re opting for this cover) to ensure that you’re not leaving any value out when you generate your quote."

Nick Jackson

Home Insurance Expert