Letting your car insurance auto-renew with your existing supplier is the quickest route to

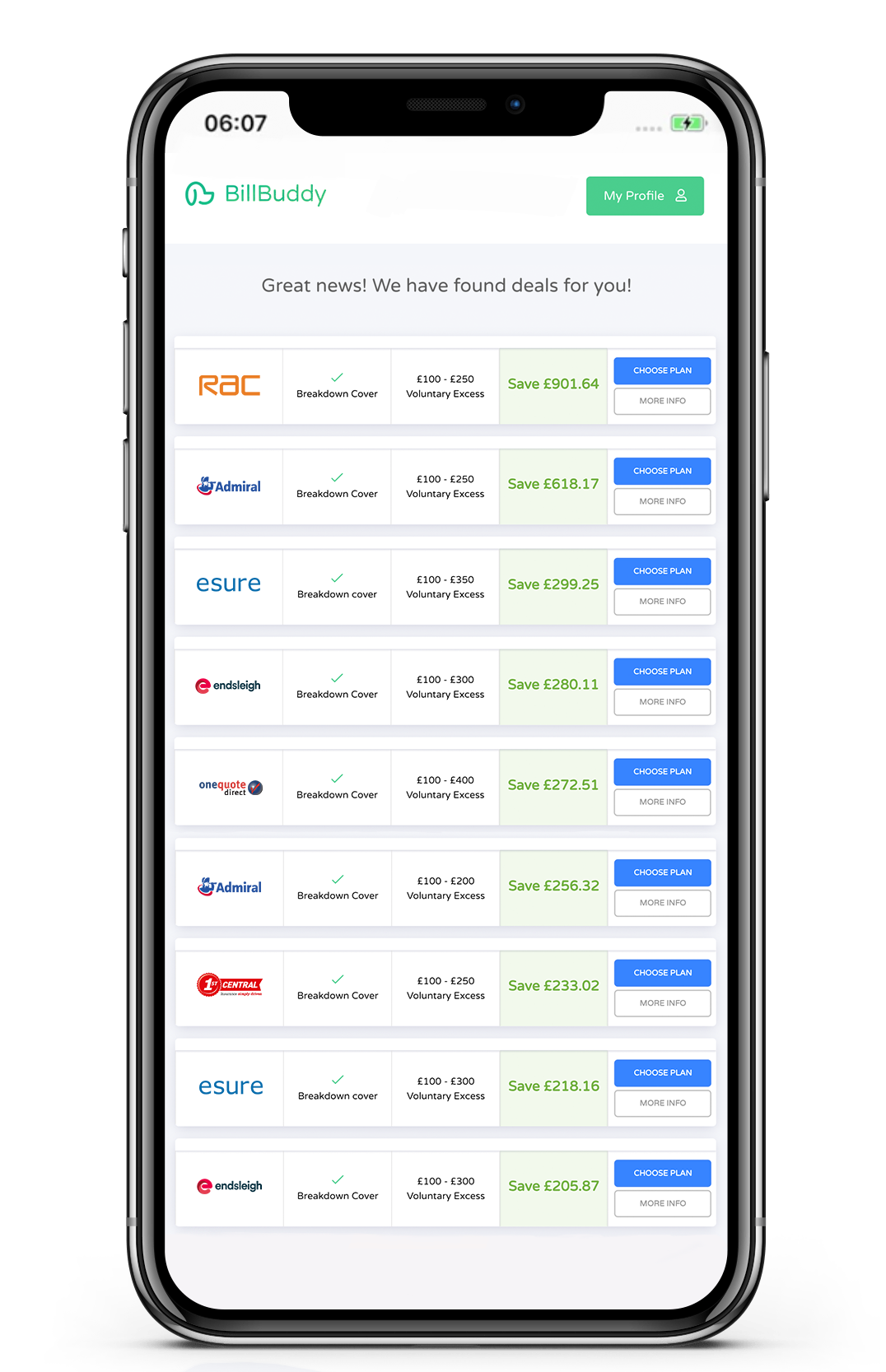

overpaying, so switching is vital. Motorists often save hundreds by switching car insurance provider each year

and when it’s as easy as this, there’s no excuse not to!

Getting a car insurance quote with BillBuddy is seamless - simply tell us about the vehicle you’re looking to insure

and a bit about you (and anybody else you want to insure) and we’ll search the market for a deal.

Even though car insurance rates have fallen slightly over the past few years, some motorists aren’t benefiting

because they choose to stick with the same insurer year after year.

Let’s put some of that money back in your pocket!

The cost of your car insurance varies on a large number of factors, so it’s hard to say without knowing more about the car and the drivers. Things like where you live, where the car is kept during the day and overnight, the price and age of the car and many more factors are considered, so it’s best that you do a quick quote and find out your savings.

Whilst there’s a lot of talk about the factors that can lead to your premium going up (modifying your car, for example), people rarely talk about what can help bring it back down. One such way, which is growing in popularity, is installing a ‘black box’ or telematics device in your car. This isn’t a requirement, but insurers tend to offer lower rates to drivers when they can track their driving habits.

Just before we show you cheaper insurance deals, we’ll ask you when you want the new policy to start (this is normally on the date your existing policy is due to end). Any quote generated through BillBuddy will be valid until the date you choose for your new policy to start.

There are three levels of cover available through BillBuddy, each offering you varying levels of insurance. The highest level of cover is Fully Comprehensive cover, which will cover you against any damage to your own vehicle, as well as any damage to any third party or their property.

The second highest level is Third Party, Fire and Theft (TPFT) which covers any third party, as well as covering you for fire damage, theft or damage caused as a result of an attempted theft of your vehicle.

Finally there is Third Party insurance, which only covers you for damage caused to a third party or their property - nothing else.

Car (and other types of) insurance are split into two sections - premiums and excess. The premium is the amount you will pay for the insurance in total - for example £50 a month or £600 for the year.

The excess is the amount that you would pay in the event that you want to make a claim, and this is split into two further parts - the voluntary and the compulsory excess. The compulsory excess is self-explanatory and is the amount that you have to pay if you want to make a claim on your insurance policy. The voluntary excess is the amount you volunteer to pay in the event of a claim.

Why would you ever volunteer to pay more? Well, insurers know that in the event of a claim, their costs would be reduced (as you’re paying more voluntarily), so they may discount your premium in return.

"It’s important to think about your excess when generating a car insurance quote, as that’s an aspect that can really help to bring your premium down. Also, pay attention to the additional perks of a premium - things like access to a courtesy car or breakdown cover."

Nick Jackson

Car Insurance Expert

What Is Car Insurance & Why Do I Need It?

Everything you need to know to stay protected on the road

Read More...

10 Essential Tips For Cheaper Car Insurance

Looking for better advice than installing a black box? Look no further...

Read More...